This printed article is located at https://gdsglobal.listedcompany.com/financials.html

Financials Results

UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 31 MARCH 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

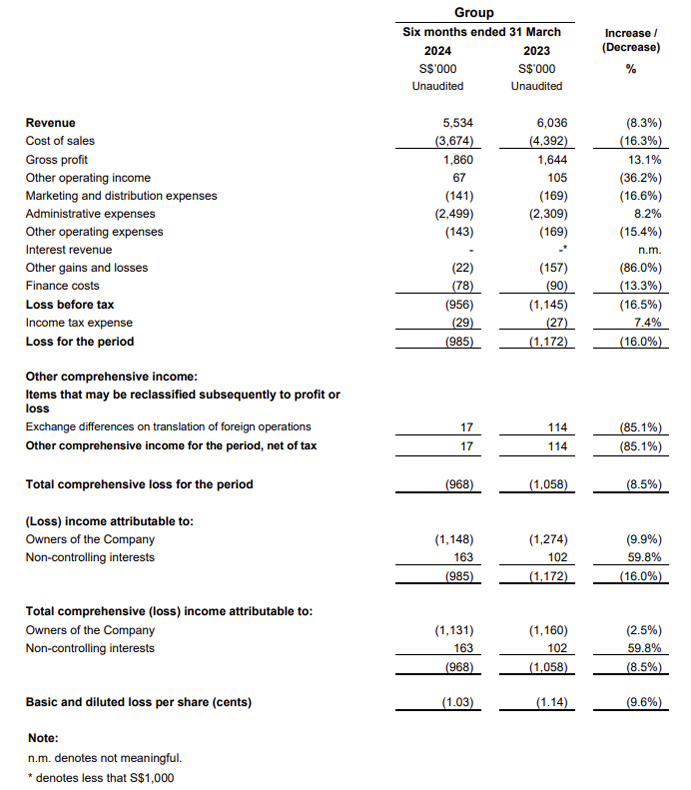

Condensed interim consolidated statement of profit or loss and other comprehensive income

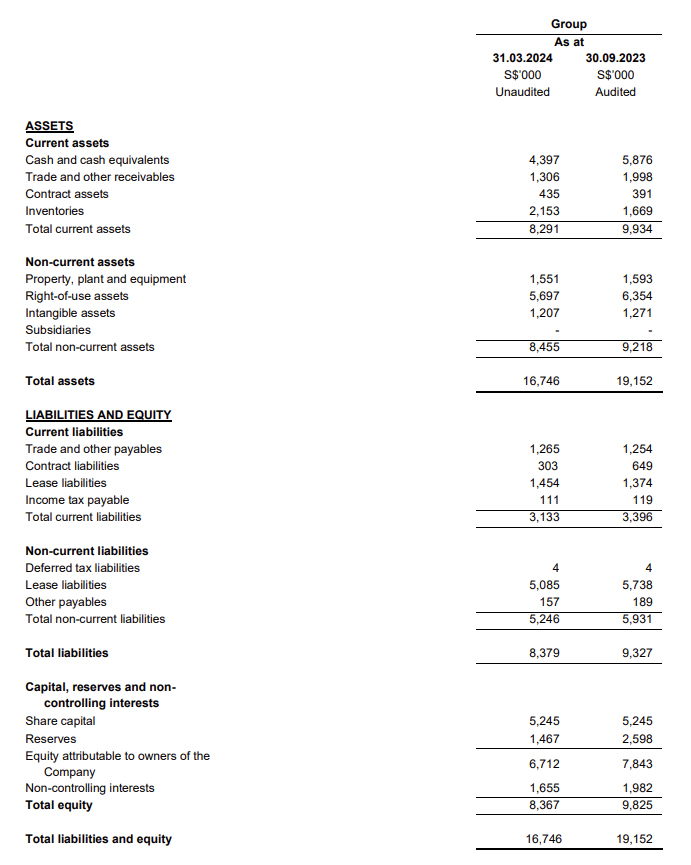

Condensed interim statements of financial position

Review of the Group's Financial Performance

Revenue

For the sales of doors and shutter systems, the Group typically experiences a fluctuation in revenue contribution from its customers from period to period due to the project-based nature of its business. The Group’s projects differ in their scope and size and are typically non-recurring.

The Group’s revenue for the six-month period ended 31 March 2024 (“1H2024”) was S$5.53 million, a decrease of S$0.51 million or 8.3% as compared to S$6.04 million for the corresponding six-month period ended 31 March 2023 (“1H2023”).

The decrease of S$0.51 million was mainly due to projects completion timing and slower demand for trading components.

Cost of sales

Cost of sales decreased by S$0.72 million or 16.3% mainly due to lower sub-contractor cost ((S$0.15 million) due to absence of a one-off project in 1H2023 which required specialised sub-contractor work), fewer spare parts purchased for special application shutters (S$0.24 million) and decrease in material purchased, which is in line with the decrease in revenue.(S$0.21 million).

Gross profit

Gross profit increased by S$0.22 million or 13.1% mainly from door and shutter systems business, due to decrease in materials purchased and lower sub-contractor cost. Gross profit margin increased from 27.24% in 1H2023 to 31.61% in 1H2024 due to decreased material and sub-contractor costs as elaborated above.

Other operating income

Other operating income decreased by S$0.04 million or 36.2% mainly due to the absence of government grants and lower government incentives received in 1H2024.

Marketing and distribution expenses

Marketing and distribution expenses decreased by S$0.03 million or 16.6% due to decrease in local logistics transport cost (less demand by clients for usage of suppliers’ cranes to transport forklift and scissor lift to site) and freight & storage costs (cessation of storage of our products at overseas warehouse).

Administrative expenses

Administrative expenses increased by S$0.19 million or 8.2% due to higher professional fees (S$0.10 million), salaries cost (S$0.03 million), depreciation and amortisation (S$0.03 million) and onboarding of a new contract staff (S$0.02 million).

Other operating expenses

Other operating expenses decreased by S$0.03 million or 15.4%. The decrease mainly due to lower research and development expense incurred.

Interest revenue

Interest revenue comprised interest income from flexi-yield deposits placed with bank. We have closed the flexi-yield account in FY2023, thus no interest was received in 1H2024.

Other gains and losses

Other gains and losses decreased by S$0.14 million or 86% due to revaluation of foreign currencies in a subsidiary’s assets (mainly US-denominated trade receivables and bank balances).

Finance costs

Finance costs decreased by S$0.01 million or 13.3% due to lower interest for Right-of-use (“ROU”) assets in 1H2024.

Income tax expense

The income tax expense increased by S$2,000 from S$27,000 to S$29,000. The increase in income tax expense was mainly due to higher taxable profit from a subsidiary in 1H2024.

Loss for the period

As a result of the above, the Group reported a loss of S$0.99 million for 1H2024 as compared to a loss of S$1.17 million in 1H2023.

Review of the Group's Financial Position

Current assets

Current assets decreased by S$1.64 million from S$9.93 million as at 30 September 2023 to S$8.29 million as at 31 March 2024. The decrease in current assets was mainly due to:

- a decrease in cash and cash equivalents of S$1.48 million;

- a decrease in trade and other receivables of S$0.69 million due to lower revenue generated; which was

offset by; - an increase in inventories of S$0.48 million to maintain stock levels for certain components;

Non-current assets

Non-current assets decreased by S$0.76 million from S$9.22 million as at 30 September 2023 to S$8.46 million as at 31 March 2024. The decrease in non-current assets was mainly due to current year depreciation and amortisation of property, plant & equipment, ROU asset, and intangible assets.

Current liabilities

Current liabilities decreased by S$0.27 million from S$3.40 million as at 30 September 2023 to S$3.13 million as at 31 March 2024. The decrease in current liabilities was mainly due to:

- decrease in contract liabilities (deposit received from customers) of S$0.35 million:

partially offset by

- increase in lease liabilities (ROU asset) of S$0.08 million.

Non-current liabilities

Non-current liabilities decreased by S$0.68 million from S$5.93 million as at 30 September 2023 to S$5.25 million as at 31 March 2024. The decrease in non-current liabilities was mainly due to a decrease in lease liabilities (ROU asset) of S$0.65 million.

Capital, reserves and non-controlling interests

Total equity decreased by S$1.46 million from S$9.83 million as at 30 September 2023 to S$8.37 million as at 31 March 2024, mainly from current year losses.

Review of the Group's Cash Flows

Net cash from operating activities

In 1H2024, the Group generated cash from operating activities before movement in working capital of S$101,000. The Group’s cash used from operations amounted to S$0.05 million due to:

- increase in inventories of S$0.48 million

- increase in contract assets (accrued revenue) of S$0.04 million

- increase in trade and other payables of S$0.03 million

offset by;

- decrease in trade and other receivables of S$0.69 million

- decrease in contract liabilities (deposit received from customers) of S$0.35 million.

Net cash used in investing activities

Net cash used in investing activities amounted to S$0.13 million, due to the purchase of property, plant and equipment.

Net cash used in financing activities

Net cash used in financing activities was S$1.18 million which was mainly due to the repayment of lease liabilities (ROU asset) of S$0.69 million and payment of dividend to non-controlling shareholders of S$0.49 million.

Commentary

The doors and shutters industry is expected to remain challenging and competitive as most economies are still recovering from Covid-19 pandemic aftermath and higher cost worsened by heightened tensions in the Middle East and the Russia – Ukraine conflict.

For our doors and shutters business, the Group still expects to experience some delays in scheduled installations due to higher material and labour costs delaying progress in construction projects where the Group is one of the end-process contractors.

For our trading of production components segment, the Group expects soft demand in the next 6 -12 months with the prolonged Russia – Ukraine conflict affecting the European bloc where most of our customers are.

Nevertheless, the Group, under a new leadership structure from November 2023, is cautiously optimistic of some recovery in the next 12 months in light of local public project opportunities in the building and construction sector and Group’s own strategic initiatives. In Singapore, public projects have propped up growth in the building and construction industry in the first quarter of this year. The Group had recently intensified its sales and marketing efforts to increase local and overseas sales and market share. Concurrently, the Group will focus on improving its products offering, service and maintenance resources and operational efficiencies to stay competitive. We will continually evaluate strategies to navigate industry challenges.