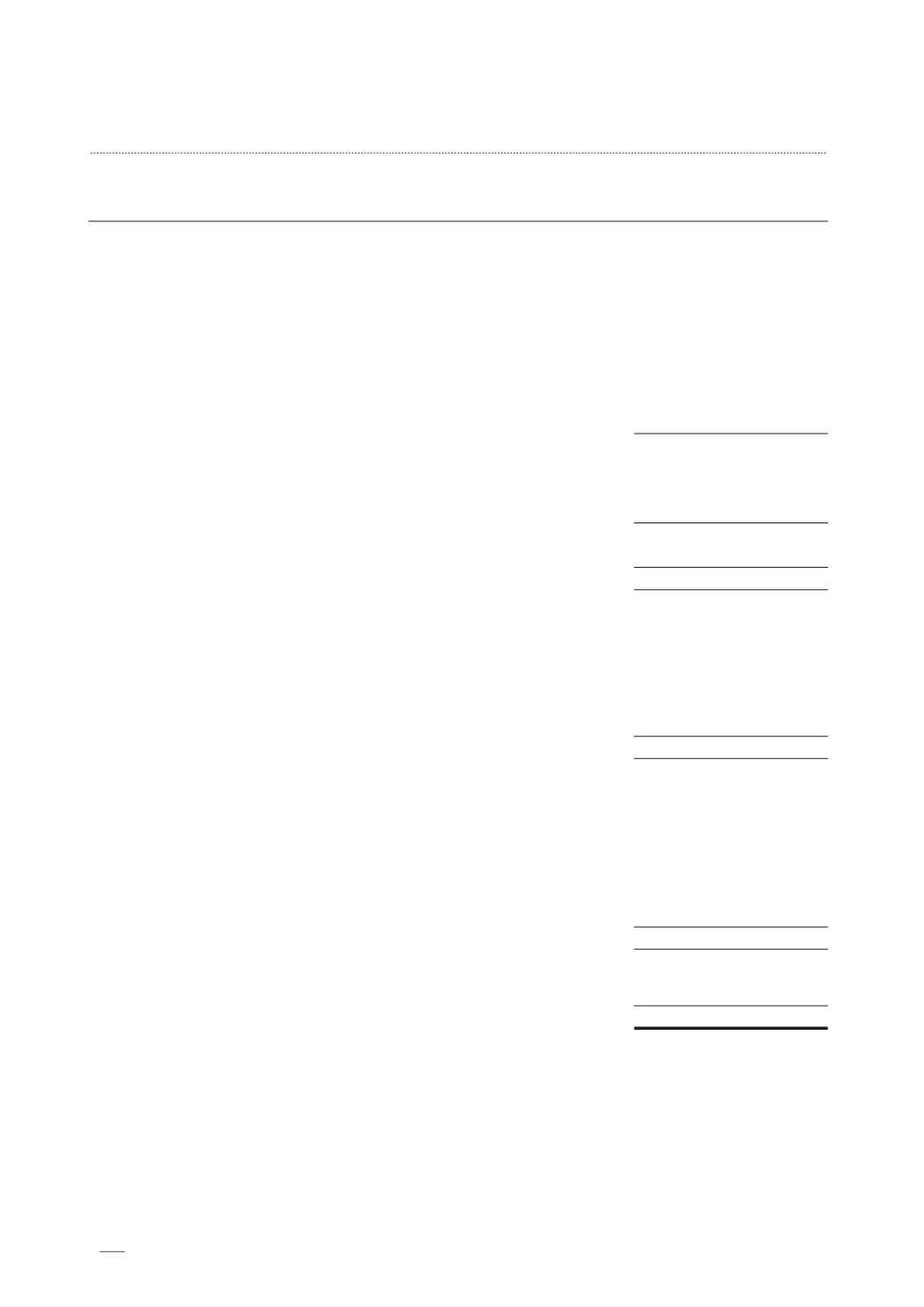

52

GDS Global Limited Annual Report 2015

CONSOLIDATED STATEMENT OF

CASH FLOWS

For the financial year ended 30 September 2015

See accompanying notes to financial statements.

Group

2015

2014

$

$

Operating activities

Profit before income tax

3,663,083

5,014,131

Adjustments for:

Interest income

(16,353)

(15,676)

Finance costs

609

5,140

Depreciation of property, plant and equipment

338,430

299,945

Amortisation of intangible asset

94,335

94,336

Gain on disposal of property, plant and equipment

(37,646)

(15)

Operating cash flows before movements in working capital

4,042,458

5,397,861

Inventories

64,838

448,182

Trade and other receivables

241,613

(2,129,997)

Trade and other payables

(1,395,219)

1,607,398

Cash generated from operations

2,953,690

5,323,444

Income tax paid

(541,211)

(38,125)

Net cash from operating activities

2,412,479

5,285,319

Investing activities

Purchase of property, plant and equipment

(1,338,427)

(802,494)

Increase in pledged bank deposits

(130,805)

–

Advance of loan to a third party

(503,750)

–

Proceeds from disposal of property, plant and equipment

66,913

24,194

Interest received

16,353

15,676

Net cash used in investing activities

(1,889,716)

(762,624)

Financing activities

Dividends paid

(1,456,000)

(784,000)

Repayment of bank borrowings

(5,813)

(183,136)

Repayment of obligations under finance leases

(3,480)

(19,986)

Capital contribution from non-controlling interests in a subsidiary

284,850

–

New bank loans raised

654,000

–

Interest paid

(609)

(5,140)

Net cash used in financing activities

(527,052)

(992,262)

Net (decrease) increase in cash and cash equivalents

(4,289)

3,530,433

Cash and cash equivalents at beginning of year

8,098,806

4,568,373

Cash and cash equivalents at end of year (Note 6)

8,094,517

8,098,806