9

GDS Global Limited Annual Report 2015

OPERATIONS AND

FINANCIAL REVIEW

For the financial year ended 30 September 2015 (

“FY2015”

), the Group reported a net profit of S$3.35

million as revenue dropped 8.4% to S$21.88 million as compared to the financial year ended 30 September

2014 (

“FY2014”

).

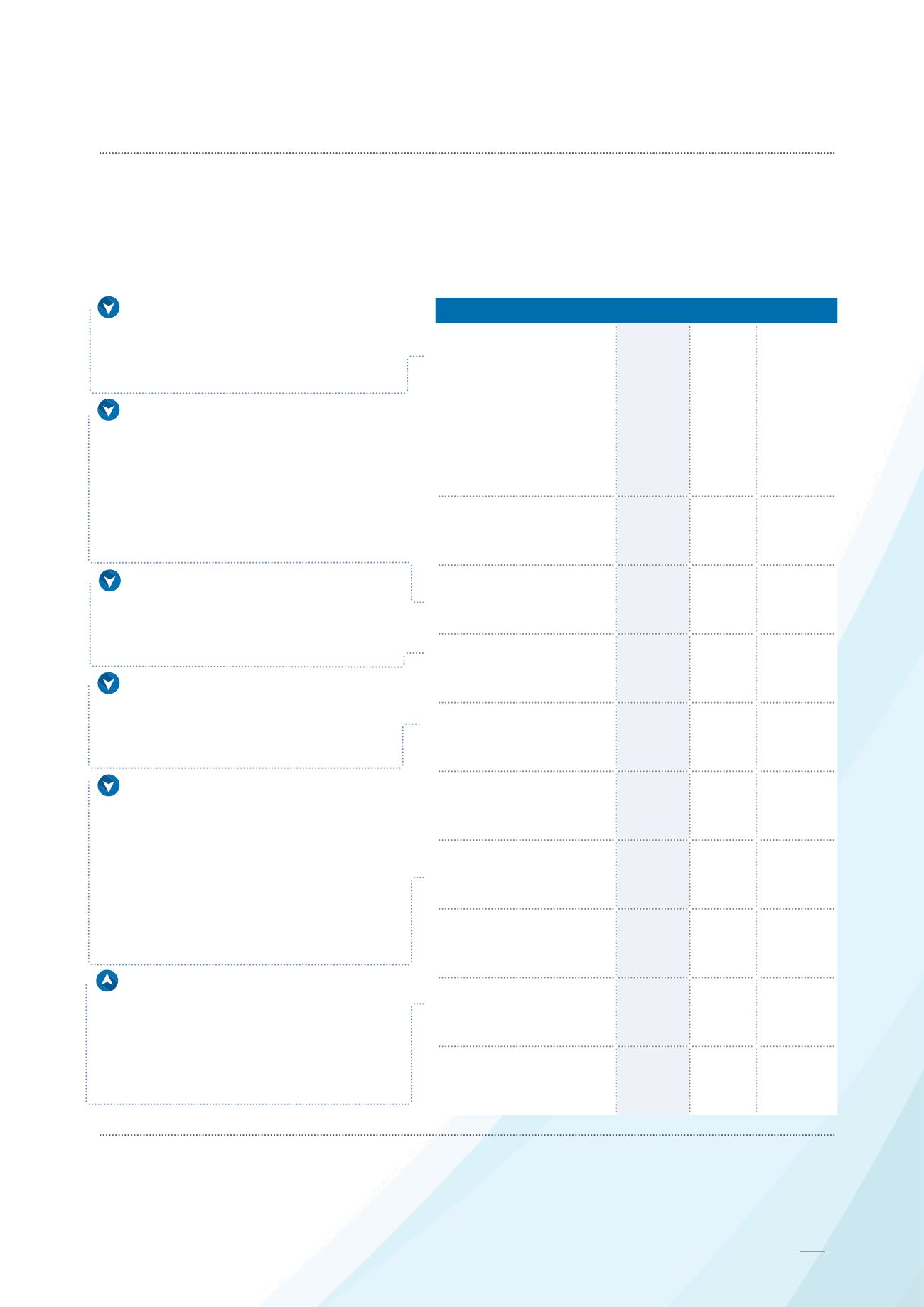

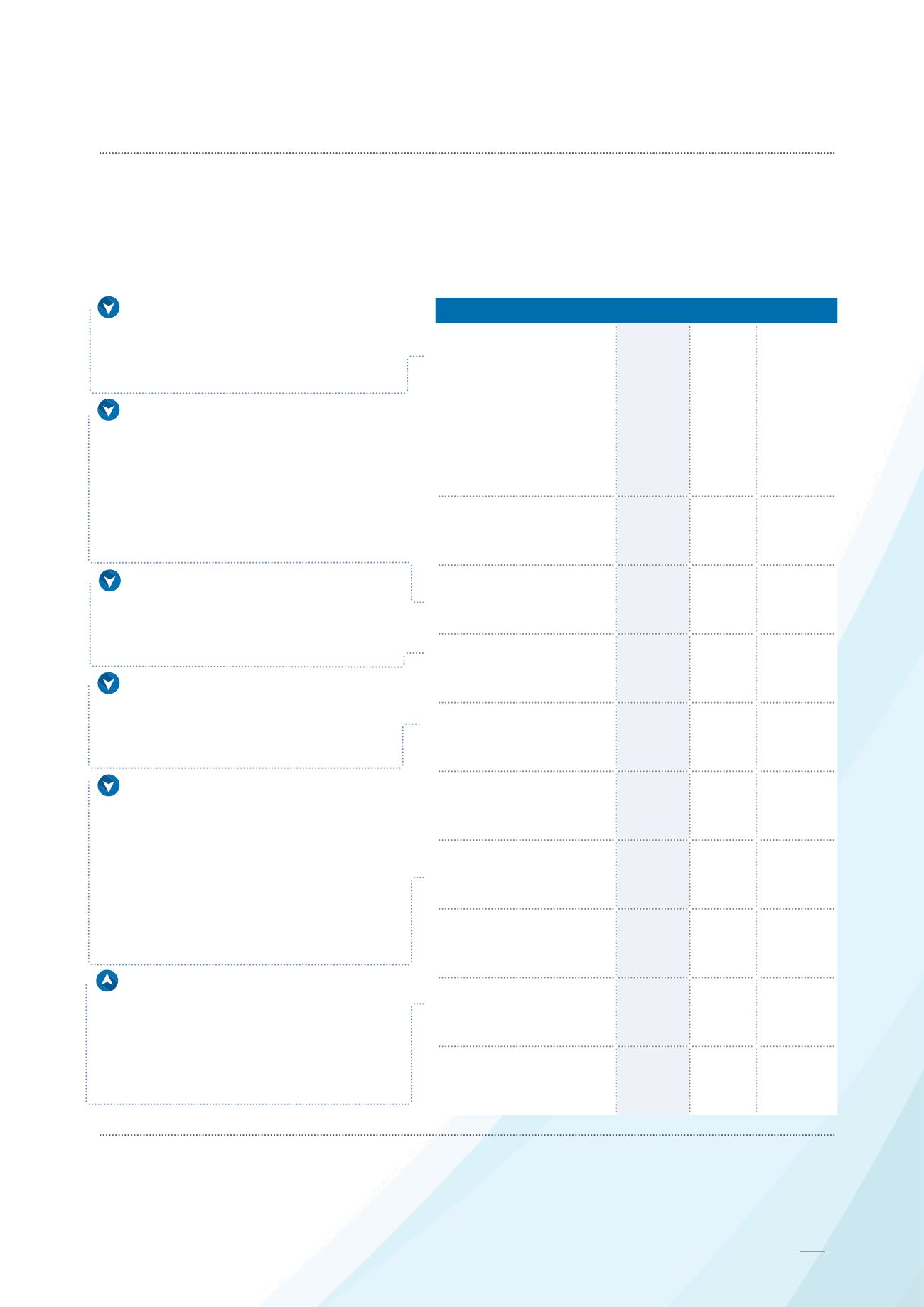

INCOME STATEMENT

S$’000

FY201

5

FY2014 Change(%)

Revenue

2

- Sale of door and

shutter systems

- Provision of service

and maintenance

works

21,879

20,291

1,588

23,872

22,156

1,716

(8.4)

(8.4)

(7.5)

Cost of sales

(12,332)

(12,779)

(3.5)

Gross profit

9,547

11,093

(13.9)

Other operating income

301

613

(51.0)

Marketing and

distribution expenses

(639)

(780)

(18.1)

Administrative expenses

(5,627)

(5,621)

0.1

Other operating

expenses

(289)

(343)

(15.8)

Investment revenue

16

16

-

Other gains and losses

355

41

762.8

Finance costs

(1)

(5)

(88.2)

2

The Group operates and manages its business primarily as a single operating segment in the manufacture and supply of door and

shutter systems and provision of service and maintenance works. As such, no operating segmental revenue and results have been prepared.

Revenue:

Due to the decrease in the

sale of door and shutter systems which was

mainly attributed to the absence of sales

arising from delayed projects which spilled

over from FY2013 to FY2014.

Gross profit:

Gross profit margin

decreased from 46.5% in FY2014 to 43.6%

in FY2015, which was mainly attributed to

some items of cost in the cost of sales,

which were fixed in nature. Accordingly,

the lower revenue in FY2015 did not

result in a proportional decrease in cost of

sales and gross profit margin was lower in

FY2015.

Other operating income:

Mainly

attributed to the decrease in rental income

arising from the cessation of the sub-letting

of the Group’s premises in July 2014 upon

the termination of the lease.

Marketing and distribution expenses:

Mainly attributed to the decrease in

transportation expenses which was in

line with the decrease in revenue during

FY2015.

Other operating expenses:

Mainly

due to the absence of impairment loss on

trade receivables arising from customers

placed under liquidation of S$0.16 million

which occurred in FY2014.

This was partially offset by the increase in

(i) research and development expenses

of S$0.06 million; and (ii) repair and

maintenance expenses of S$0.04 million in

FY2015.

Other gains and losses:

Mainly

attributed to the increase in (i) net foreign

exchange gains of S$0.28 million arising

from the translation of trade receivables

and bank balances denominated in US$;

and (ii) gain on disposal of property, plant

and equipment of S$0.04 million.