10

GDS Global Limited Annual Report 2015

OPERATIONS AND

FINANCIAL REVIEW

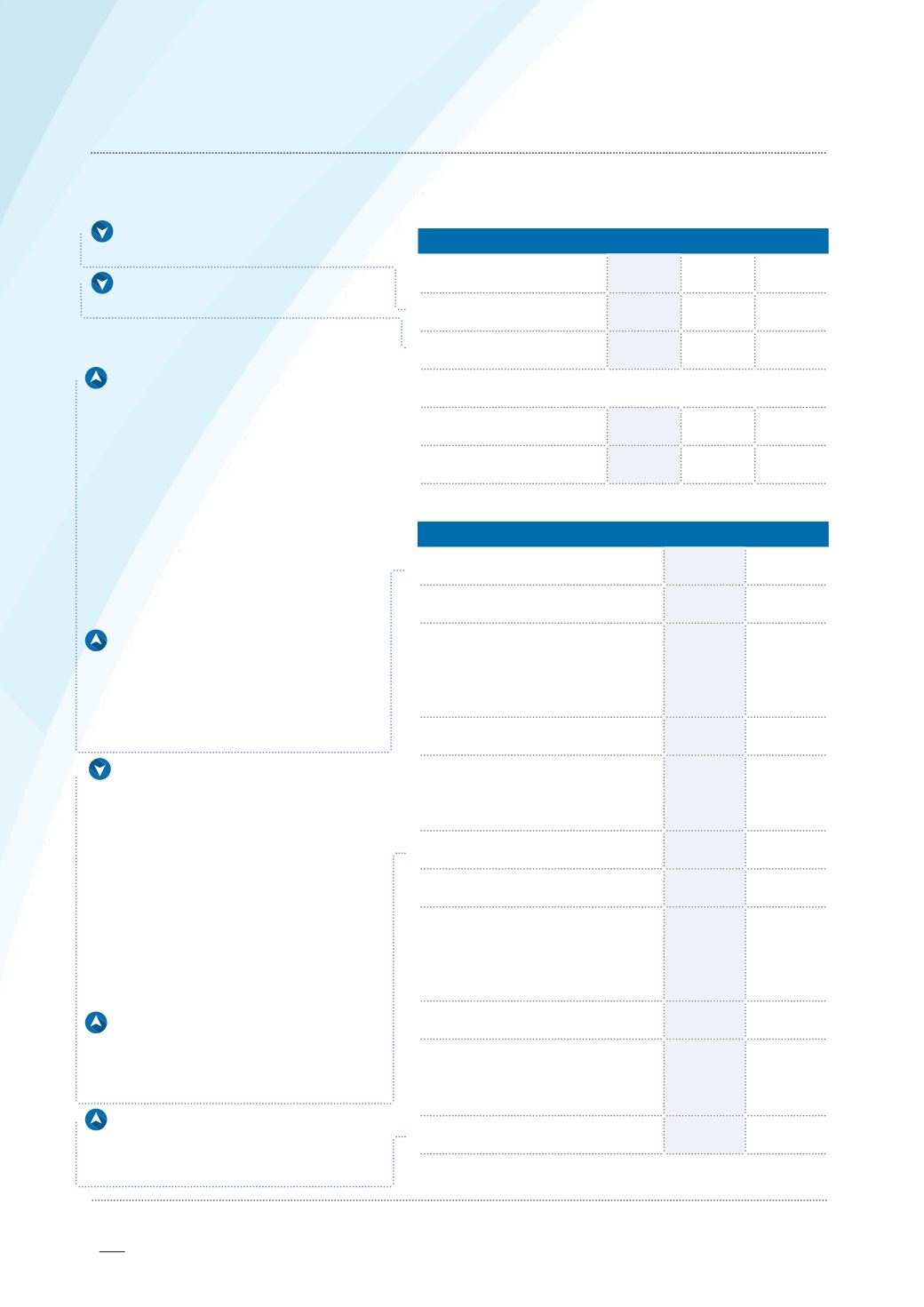

INCOME STATEMENT (CONT’D)

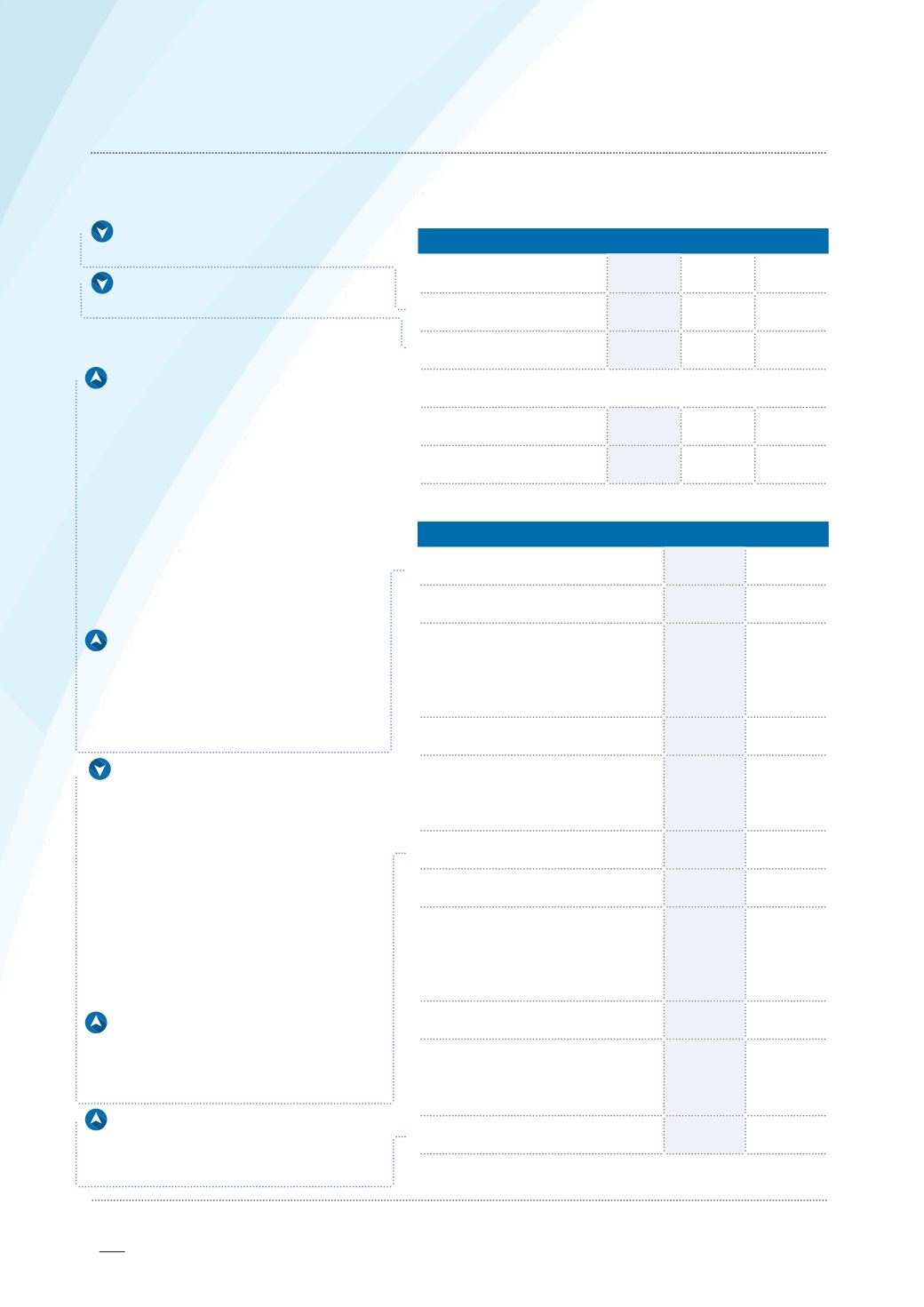

FINANCIAL POSITION

S$’000

FY2015

FY2014 Change(%)

Profit before tax

3,663

5,014 (26.9)

Income tax expense

(318)

(608)

(47.7)

Profit for the year

3,345

4,406 (24.1)

Profit (Loss) attributable to:

Owners of the Company

3,288

4,512 (27.1)

Non-controlling interests

57

(106)

n.m.

3

S$’000

FY2015

FY2014

Total Assets

23,973

22,838

Total current assets

20,027

18,906

Cash and cash equivalents

Pledged bank deposits

Trade and other receivables

Inventories

8,095

1,000

8,706

2,226

8,098

-

8,517

2,291

Total non-current assets

3,946

3,932

Property, plant and equipment

Intangible asset

Pledged bank deposits

2,550

1,266

130

1,572

1,360

1,000

Total Liabilities

4,410

5,384

Total current liabilities

3,452

5,034

Bank borrowings

Trade and other payables

Current portion of finance leases

Income tax payable

131

3,116

-

205

-

4,515

3

516

Total non-current liabilities

958

350

Bank borrowings

Deferred tax liabilities

Other payables

517

424

17

-

336

14

Total Equity

19,563

17,454

Income tax expense:

In line with the

lower profit before tax in FY2015.

Profit for the year:

Mainly a result of

the above.

Current assets:

Mainlydue to the increase

in (i) pledged bank deposits maturing within

the next twelve months of S$1.00 million as

such deposits were reclassified from non-

current assets as at 30 September 2014 to

current assets as at 30 September 2015; and

(ii) trade and other receivables of S$0.19

million mainly attributed to the increase in (a)

trade receivables of S$0.81 million as a result

of slower repayments from customers in

FY2015; (b) other receivables of S$0.51 million

arising from the advance of loan to a third

party; and (c) prepayments of S$0.15 million,

partially offset by the decrease in deposits

placed for the purchase of inventories from

the Group’s principals of S$1.26 million.

Non-current assets:

Due to the purchase

of property, plant and equipment, partially

offset by depreciation and amortisation

during FY2015. The increase was also

partially offset by the reclassification of

pledged bank deposits from non-current

assets to current assets as explained above.

Current liabilities:

Mainly due to the

decrease in (i) trade and other payables

of S$1.40 million mainly attributed to

the decrease in deposits received from

customers of S$1.99 million, partially offset

by increase in trade payables of S$0.69

million as the Group made payments in

respect of a smaller proportion of trade

payables; and (ii) income tax payable of

S$0.31 million.

This was partially offset by the increase in bank

borrowings (current) of S$0.13 million due to

new loans of S$0.65 million drawn down by a

subsidiary forworkingcapitalpurposes inFY2015.

Non-current liabilities:

Due to the increase

in (i) bank borrowings (non-current) of S$0.52

million due to new loans drawn down by a

subsidiary as explained above; and (ii) deferred

tax liabilities of S$0.09 million.

Total equity:

Mainly due to the profits

earned and changes in non-controlling

interests during FY2015, partially offset by

the dividends paid.

3

n.m. denotes not meaningful.