NOTES TO

FINANCIAL STATEMENTS

69

GDS Global Limited Annual Report 2015

As at 30 September 2015

4

FINANCIAL INSTRUMENTS, FINANCIAL RISKS AND CAPITAL MANAGEMENT

(a)

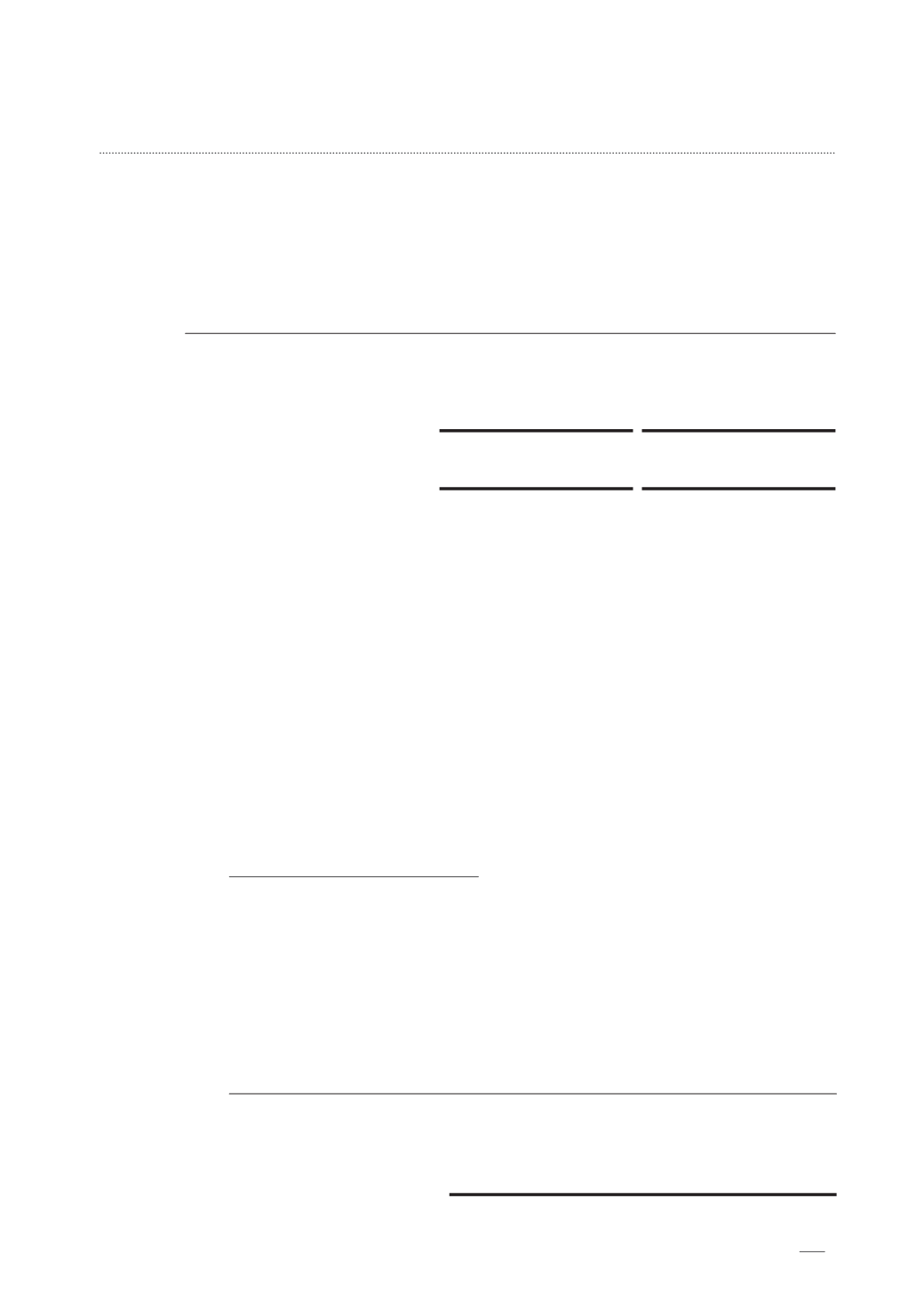

Categories of financial instruments

The following table sets out the financial instruments as at the end of the reporting period:

Group

Company

2015

2014

2015

2014

$

$

$

$

Financial assets

Loans and receivables (including

cash and cash equivalents)

17,532,189

17,365,082

4,169,623

5,098,508

Financial liabilities

Amortised cost

3,337,821

2,101,777

212,527

230,968

(b) Financial instruments subject to offsetting, enforceable master netting arrangements and

similar agreements

The Group and the Company do not have any financial instruments which are subject to

enforceable master netting arrangements or similar netting agreements.

(c)

Financial risk management policies and objectives

The Group’s overall financial risk management policies and objectives seek to minimise

potential adverse effects on the financial performance of the Group. Risk management is

carried out by the board of directors and periodic reviews are undertaken to ensure that

the Group’s policy guidelines are complied with. There has been no change to the Group’s

exposure to these financial risks or the manner in which it manages and measures the risk.

The Group does not hold or issue derivative financial instruments for speculative purposes.

The Company is not exposed to significant foreign exchange risk, interest rate risk, credit risk

and liquidity risk.

(i)

Foreign exchange risk management

The Group transacts business in various foreign currencies, including the United States

dollar, Australian dollar and Euro and therefore is exposed to foreign exchange risk.

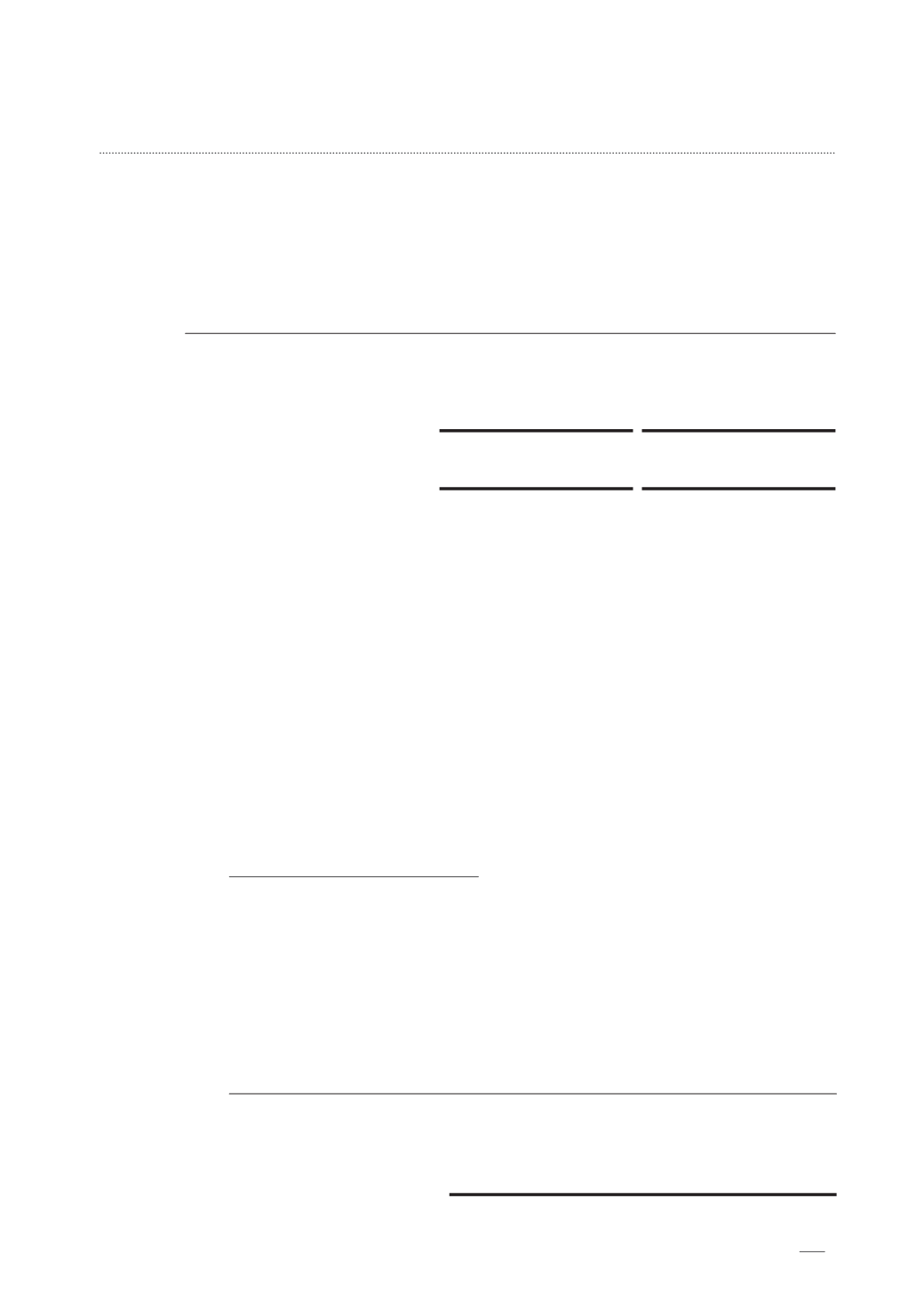

At the end of the reporting period, the carrying amounts of monetary assets and

monetary liabilities denominated in currencies other than the respective entities’

functional currencies are as follows:

Group

Assets

Liabilities

2015

2014

2015

2014

$

$

$

$

United States dollar

948,493

1,497,897

39,394

15,208

Australian dollar

503,750

7

21,466

2,354

Euro

3,596

3,620

42,368

7,365