74

GDS Global Limited Annual Report 2015

NOTES TO

FINANCIAL STATEMENTS

As at 30 September 2015

6

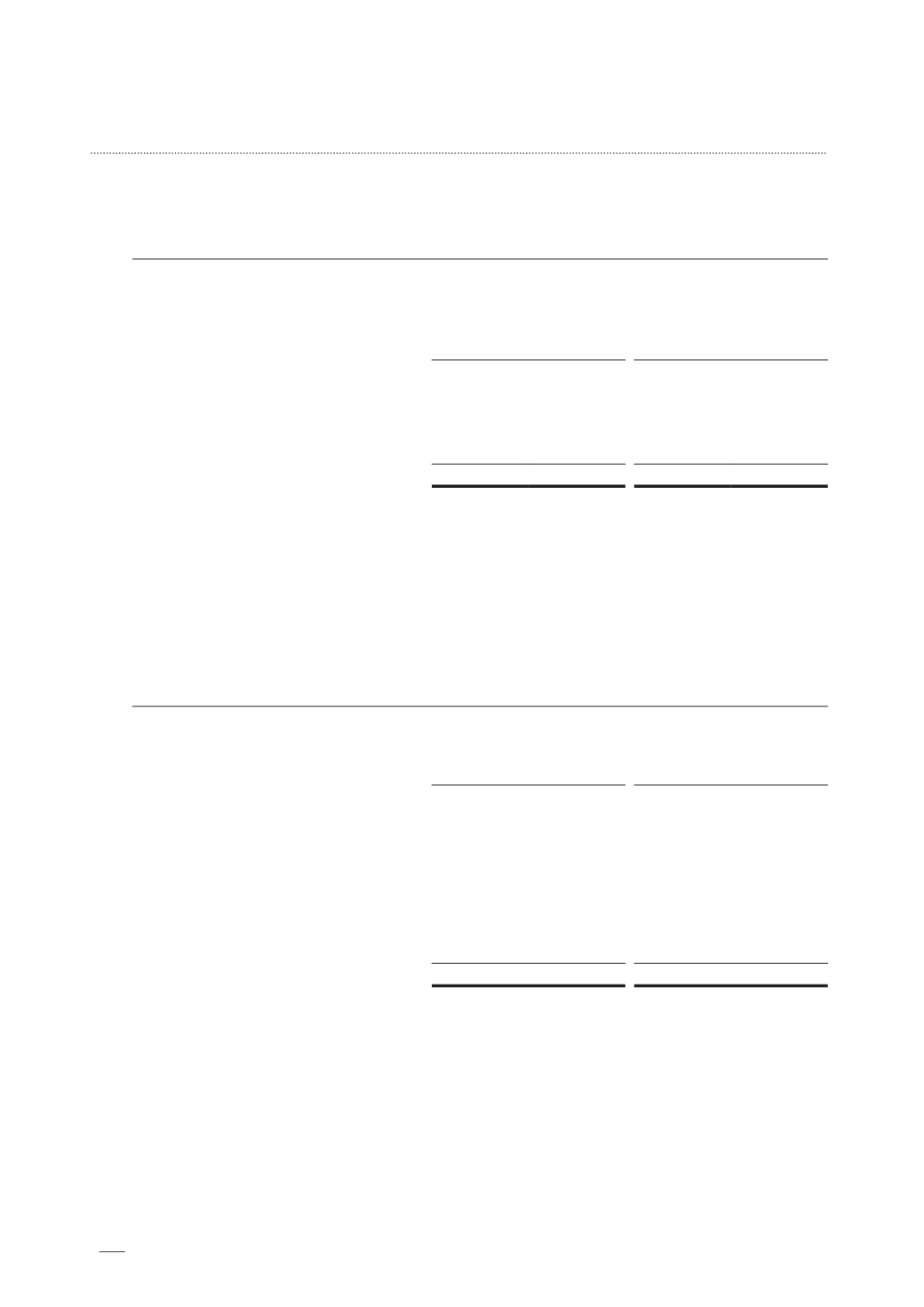

CASH AND CASH EQUIVALENTS AND PLEDGED BANK DEPOSITS

Group

Company

2015

2014

2015

2014

$

$

$

$

Cash on hand

4,010

9,875

7

7

Cash at banks

8,090,507

8,088,931

684,195

2,025,147

Bank deposits

1,130,805

1,000,000

–

–

9,225,322

9,098,806

684,202

2,025,154

Less: Pledged bank deposits (shown

under non-current assets)

(130,805)

(1,000,000)

–

–

Pledged bank deposits (shown

under current assets)

(1,000,000)

–

–

–

Cash and cash equivalents

8,094,517

8,098,806

684,202

2,025,154

Bank deposits bear average effective interest rate of 1.5% (2014: 1.5%) per annum and for a tenure

of approximately 1 to 5 years (2014: 2 years). Bank deposits of $1,000,000 (2014: $1,000,000) and

$130,805 (2014: Nil) are pledged to banks to secure banking facilities and bank loans (Note 12)

respectively.

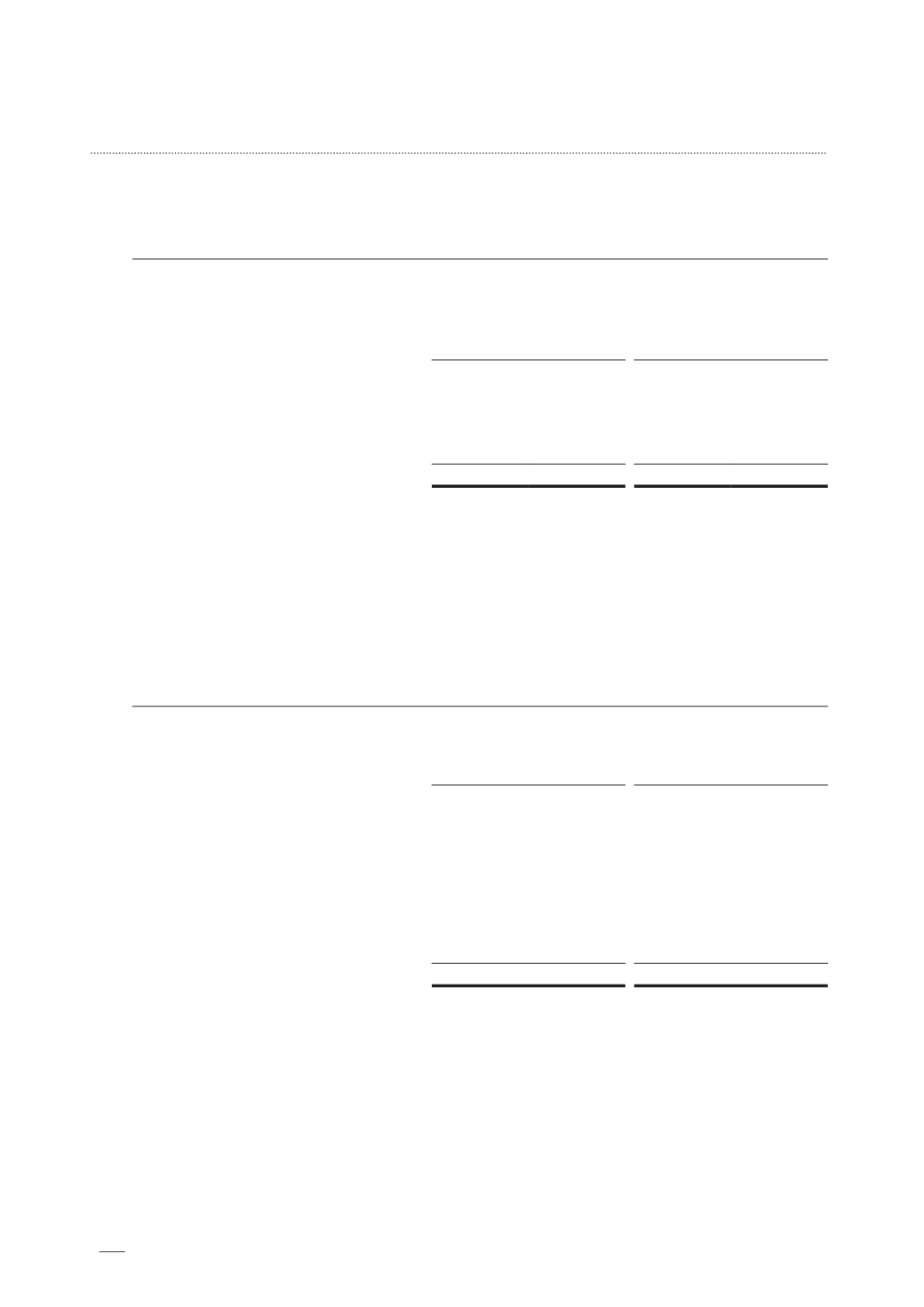

7

TRADE AND OTHER RECEIVABLES

Group

Company

2015

2014

2015

2014

$

$

$

$

Trade receivables due from third parties

7,840,063

7,040,099

–

–

Allowance for doubtful debts

(154,858)

(160,634)

–

–

7,685,205

6,879,465

–

–

Trade receivables due from subsidiaries

–

–

655,421

1,043,354

Other receivables due from third parties

532,557

17,694

–

–

Other receivables due from a subsidiary

–

–

430,000

430,000

Dividends receivable from a subsidiary

–

–

2,400,000

1,600,000

Deposits

89,105

104,817

–

–

Advance payments to suppliers

–

1,264,300

–

–

Prepayments

399,282

250,505

15,472

32,212

8,706,149

8,516,781

3,500,893

3,105,566

The trade and other receivables due from subsidiaries are unsecured, interest-free and repayable

on demand.

The average credit period for trade receivables is approximately 30 to 60 days (2014: 30 to

60 days). No interest is charged on the outstanding trade receivables.

Included in other receivables due from third parties is an advance of $503,750 (2014: Nil) to a third

party under a loan agreement. This amount is unsecured, interest-free and expected to be repaid

within the next twelve months.