NOTES TO

FINANCIAL STATEMENTS

85

GDS Global Limited Annual Report 2015

As at 30 September 2015

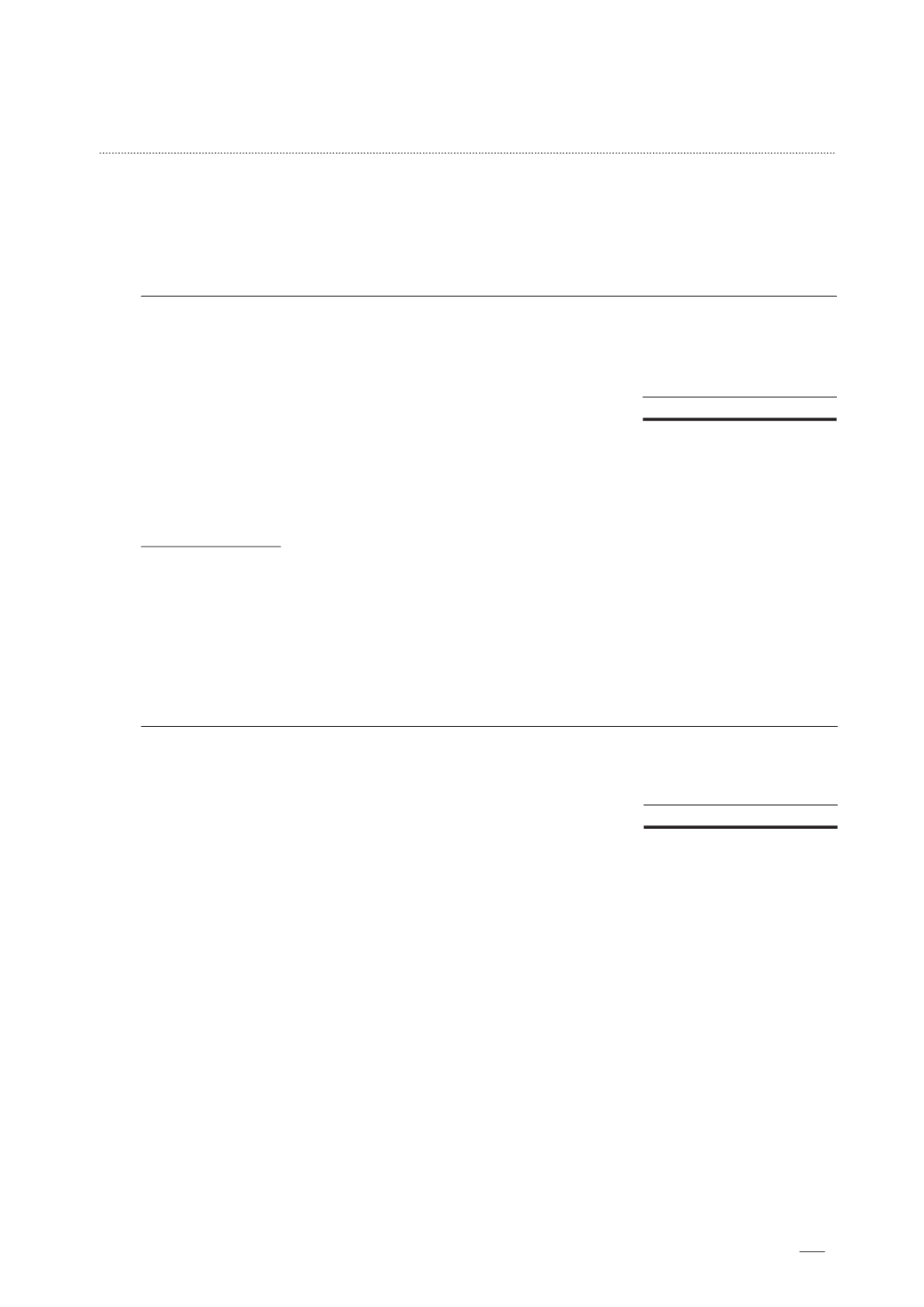

29 OPERATING LEASE ARRANGEMENTS (cont’d)

At the end of the reporting period, the Group has outstanding commitments under non-cancellable

operating leases, which fall due as follows:

Group

2015

2014

$

$

Within one year

1,306,773

1,296,386

In the second to fifth years inclusive

4,929,426

3,079,465

After five years

11,595,198

–

17,831,397

4,375,851

Operating lease payments represent rentals payable by the Group for its office and manufacturing

premises and certain equipment. The leases are negotiated for terms between 1 to 10 years

(2014: 1 to 7 years) and rentals have varying terms and escalation clauses to reflect current market

rental and value.

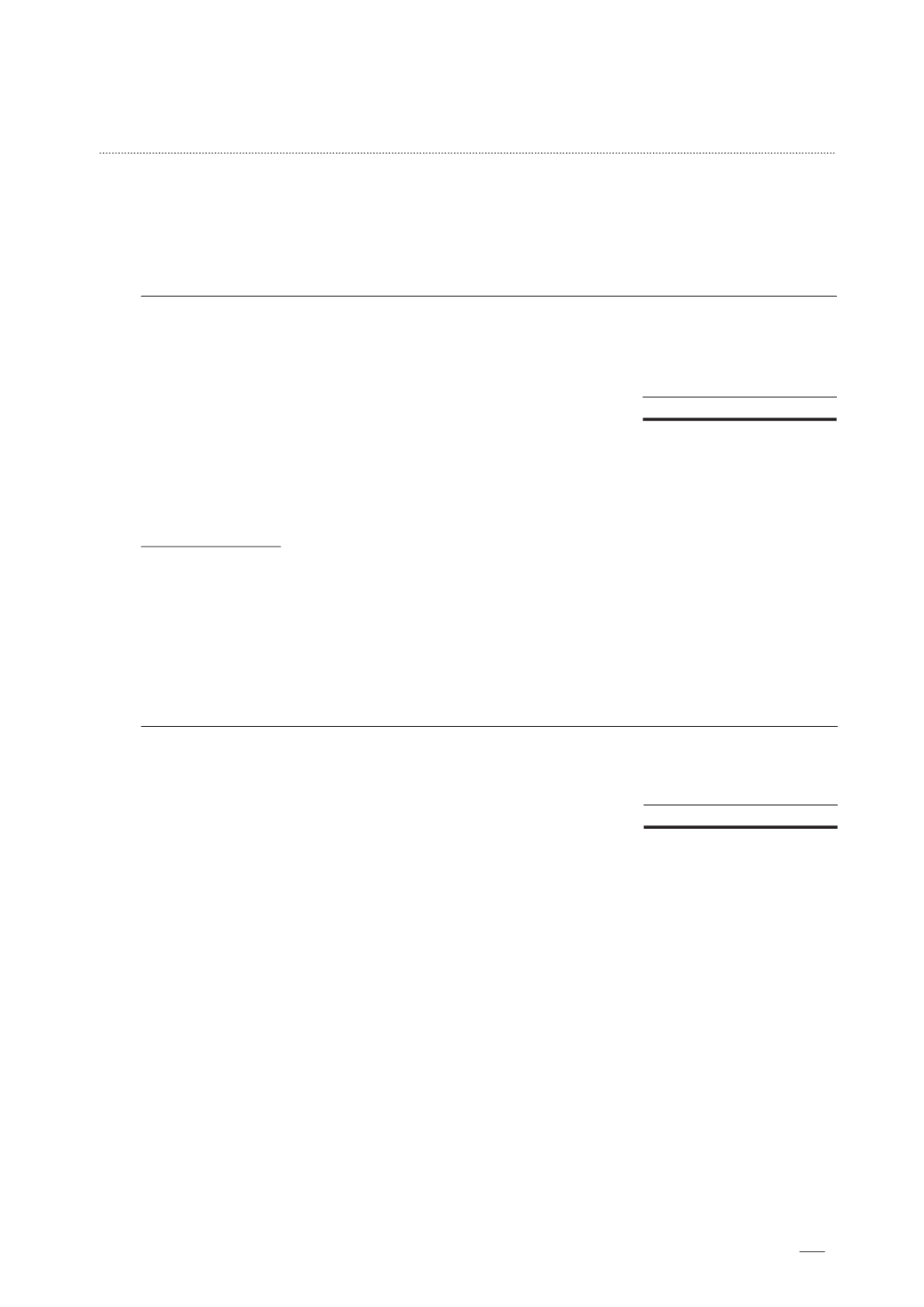

The Group as lessor

The Group has future lease income receivables in respect of the sub-leasing of its office

and manufacturing premises. The rental income earned during the financial year is $19,800

(2014: $318,192).

At the end of the reporting period, the Group’s future lease income receivables are as follows:

Group

2015

2014

$

$

Within one year

19,800

19,800

In the second to fifth years inclusive

3,300

23,100

23,100

42,900

30 SEGMENT INFORMATION

The Group operates and manages its business primarily as a single operating segment in the

manufacture and supply of door and shutter systems and provision of service and maintenance

works. The Group’s chief operating decision maker reviews the consolidated results prepared

based on the Group’s accounting policies when making decisions, including the allocation of

resources and assessment of performance of the Group.